How To Use Budget Envelopes; Take Control of Your Finances!

This post contains affiliate links; I earn a small commission when you click on the links and make a purchase.

With the new year fast approaching, My hubs and I decided it was time to get back on the Dave Ramsey bandwagon and stick to a budget. Over the years, we have gone back and forth on using an envelope budgeting system. It is excellent for keeping us on budget and our spending habits in check. Although it is a fantastic system that we thrive under, it can be cumbersome and not that easy to navigate, even more now that some places no longer accept cash payments.

So into today’s post, I will go over the cash envelope system with budget envelopes. But also show you how we use credit cards to budget and track our spending, ensuring we stay within our monthly budget.

Truth be told, Kelly and I are both spenders. 😬😆 We both enjoy nice things.

Typically one person in a marriage is the saver, and the other is the spender. But we both lucked out, and both love spending. 🤪

The good news is that I am super geeky, and I love tracking with an excel spreadsheet. So although we are both spenders, I have created money management systems to ensure that we save and are still on budget by the end of the month.

Financial well-being is a crucial part of your overall health. If you are constantly worrying about bills and do not have control of your finances, that typically flows into other areas of your life. So hang with me, and I will walk you through how to use both the cash envelope budgeting method and an electronic spreadsheet budget envelope system. Having a strategy and better understanding of where your money is going every month will provide you with an immense sense of financial peace, which is my goal!

Budgeting can seem lame and can feel restrictive, but it provides peace and allows you to keep better track of your money to meet your long-term financial goals better.

Step Number One:

Before you spend your first cent every month, the first step is to decide what you can save each month. This will become non-negotiable. You can start with a baby step and save 1% of every paycheck. The idea here is that we are creating lifelong savings habits and financial discipline. Gradually work your way up to saving more and more every time you get paid. Currently, Kelly and I tuck away 10% of every dime that comes into our bank account. This habit of saving money is essential. And once the money is in your savings account, do not touch it. This will become your emergency fund.

Step Number Two:

Next, you will create your spending plan. The best way to do that is to create an accurate idea of your spending is to go back and review your credit card and bank statements for the last few months. You may be shocked by how much you were spending on certain things. But remember, knowledge is power. List out all your regular bills and fixed expenses such as your cell phone bill, cable + streaming bill, mortgage, rent, utility bill, gas bill, insurance payments. After these fixed monthly expenses are accounted for, the rest of your money will be allotted to discretionary expenses.

Break your spending into the following budget categories:

- Food + Grocery Store

- Clothing Envelope

- Miscellaneous Purchases

- Personal Items

- Entertainment

- Gifts

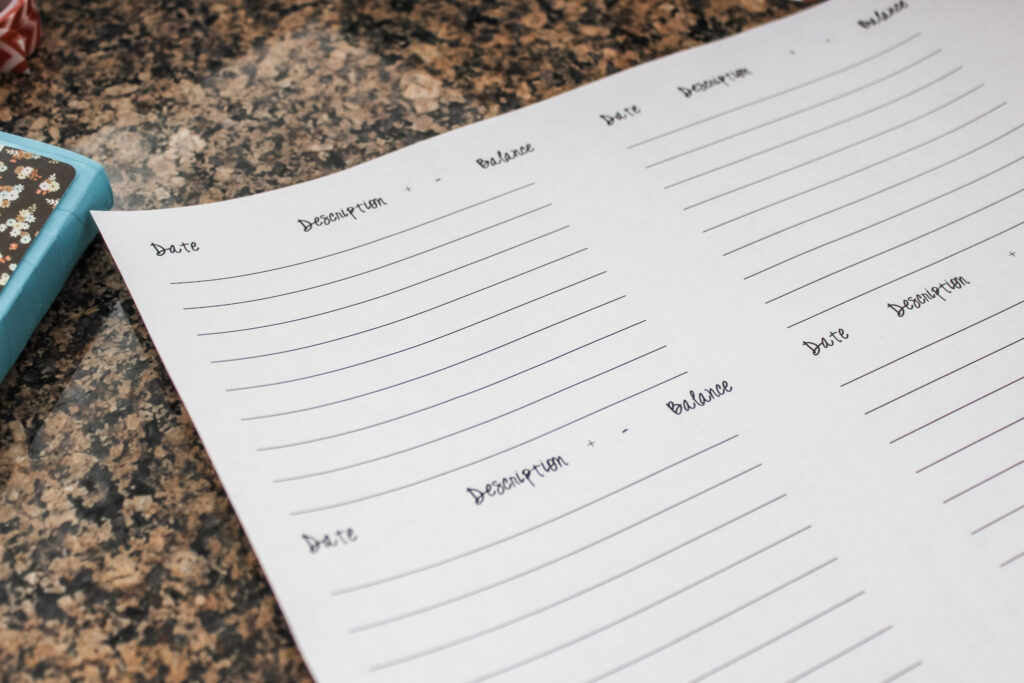

The above categories are my favorite to keep confined to cash in physical envelopes. You can divvy up leftover money into cash envelopes once you know how much money you have left after fixed expenses—setting a spending limit for each budget category. For a quick and easy option for your budget envelopes, head to the dollar store and pick up coupon size accordion folders. They are just the perfect size for keeping cash and money envelopes, plus they come with dividers to help you stay organized. They usually come in different colors and styles, so pick the one you like and personalize it. I found some cheap ones on Amazon if that works better for you. I have found it is hit or miss if Dollar Tree is currently carrying them or not. To help you out, here are the budget sheets I keep in my envelopes to help me track my spending. (They are formatted to be cut to paste and tape onto a standard size mailing envelope.

*Add loose change you receive into a jar for extra savings!

Step Number Three:

Now that you have defined your budget amount and decided how much cash you’d like to work from each month. It is time to put your plan into action. Remember that you are changing how you use money, so old habits can die hard. When I first switched to a cash system, I kept reaching for my credit card and debit card. You will need to reach for your budgeting envelopes instead, consciously. The whole idea of how the envelope system works is to tell every cent of your money where to go. It is empowering to tell your money where to go instead of wondering where it went.

Step Number Four:

Each month, review your spending and adjust your budget as needed. One of the biggest problems with budgeting is unknown or surprise expenses. So keep that in mind and set money aside for those planned “surprise expenses” such as oil changes, other car expenses, birthday gifts, and Christmas. If you notice you overspend in November and December and blow your budget, start setting money aside now in preparation for increased holiday spending. If you spend around $2,000 every year for Christmas, break it down and set aside $167 each month. The idea is that your monthly spending varies, and it can be hard to stick to a set budget, but you can even plan for that by setting aside money for those more sporadic expenses.

If you’re looking at this and thinking cash budgeting envelopes are not for you, you can still try budgeting and use an electronic budget tracking system such a Qube money or the spreadsheets I use. I use my digital tracking system more and more nowadays to help me take advantage of airline points! It’s a different way of doing things, but the concept is precisely the same. I tell my money where to go! Not the other way around.

Personal finance is essential, and it can help you with your overall health! Less stress about money = more peace and better health! And that is a win!

Happy Budgeting!

Love Dave Ramsey! Thanks for sharing your idea for cheap envelope system.

Such great information and super helpful!

I’ve never heard of this but it sounds SO helpful and efficient! Such a great way to get on track in the new year. Thank you!

This is great! Thanks for sharing!!